Why October is the Best Time to Buy a House

Posted by Staff Reporter at Realty Today (media@realtytoday.com) on Oct 05, 2015

Buying a house is no walk in the park. There are many things to consider, not to mention your bank account. But if you’re in the house-hunting phase in your life, now may be the time to make the call. Specifically, this month.

RealtyTrac recently conducted a research to find out when is the best time to make a house purchase. Analyzing more than 32 million real estate transactions since 2000, they discovered that most buyers have gotten the best deals during the month of October. During this month, the average sales price turned out to be less than 2.6 percent than the estimated full market value of the property.

This may be attributed to the fact that around this time, families are focused on getting their kids settled into the school season. Moving to a different location will disrupt this schedule, so there’s less competition in the market. This means sellers are more likely willing to negotiate.

Also, according to Time, a property’s wear-and-tear issues likely surface around fall, as temperatures drop. It’s important to inspect a home’s insulation, heating and drainage systems to make sure you are getting the right price for the house.

In contrast, RealtyTrac found out that the worst month to buy a house if you’re on a tight budget is in April, where prices soar at 1.2 percent. ( End of article.)

From Bob Phillips: Actually, any time between now and January 15th should be a great time to buy a house, before the buyers return in droves by February.

Thinking of buying? Drop me an email ( BobPhillipsRE@gmail.com ) or give me a call, ( 949-887-5305 ) and let’s talk about your best options.

What’s Your Outlook on the Real Estate Market?

An article by Colin Robertson, of TheTruthAboutMortgage.com, 7/23/2015

So here’s a true story. Yesterday, a good friend of mine asked the following question via text message: “What’s your outlook on the real estate market…we are looking to buy a place soon.”

That’s the exact message he sent over last night; there weren’t any emoticons by the way, sadly.

I saw the message but did my best to avoid answering it for about half an hour. Then I finally cracked and responded with the following:

“In a word, overpriced. But if you really want to buy a home that’s your deal. It’s not always about the investment.”

Now in the past I may have just left it at “overpriced,” but I’ve learned that such remarks are often met with resistance. I also don’t want to ruin anyone’s grand plans.

And it’s true, buying a home isn’t just about the investment. It’s not simply about timing the market and making a killer profit, that is, unless you’re a real estate investor.

For most people it’s a home. It’s a place to live. There are reasons to buy other than turning a profit.

So my outlook has changed, or perhaps broadened, to include benefits beyond making money.

But my point was basically that it’s not an ideal time to buy in terms of investment, but it could be a great time to buy a home if there’s one you really like and want to own.

At the end of the day, if he gets the home he wants, he’ll probably be happy, even if it doesn’t double in value in five years. Even if it flat lines or drops, he’ll probably still be happy if he truly loves the home.

And over time, he’ll surely build equity and come out ahead as home prices reach new heights.

National Median Sales Price Reaches All-Time High

Yesterday, the National Association of Realtors reported that the national median sales price reached an all-time high.

The price of a median existing home climbed to $236,400 in June, a 6.5% increase from a year earlier, enough to surpass the previous peak median sales price reached in July 2006 ($230,400).

For the record, the median sales price has increased year-over-year for 40 consecutive months, so yes, home prices have been on a tear.

Home sales have also been white-hot, with existing sales hitting their highest level in over eight years (February 2007).

Properties are also being scooped up faster than ever, with the average time on market only 34 days in June, down from 40 days in May, making it the shortest amount of time since NAR began tracking in 2011.

I also got word from a real estate agent friend that new home sales are picking up again. Recently, builders were offering discounts, but now that inventory is so low, they’re increasing prices and slashing discounts.

This is basically a testament to the supply/demand imbalance that is causing home prices to keep rising, and making bidding wars a common situation.

It’s for these reasons that I don’t love the current market as a buyer. At the same time, selling isn’t ideal either because there’s a good chance home prices will continue to increase.

In fact, if you look at real prices adjusted for inflation, home prices aren’t really at new all-time highs. In today’s dollars, the median would have to be closer to $260,000.

So buying because you love a home still makes sense today, as it always will. And you’ll probably do just fine if you can afford the home and stay in it for several years.

But if I had to take a side, I’d say that home prices are bloated and the competition is fierce. That certainly makes it a lot less attractive to buy today than in the very recent past. I’m taking a wait and see approach. ( End of Colin’s article.)

Comments Off on What’s Your Outlook on the Real Estate Market?

Mortgage Rates and Purchasing Power

How Does Purchasing Power Work? You’ve heard the term before — but really, what does ‘purchasing power’ mean? In its most basic form, purchasing power means what you can buy for a given amount of money. For example, a cup of coffee that cost $1 in 2010 now costs almost $4 (thanks, Starbucks!). You buy less gas with $25 today than you did a few years ago, and a car that costs $35,000 once could be bought for less than $10,000. So the purchasing power of a dollar has dropped over time. Inflation makes items cost more and lessens purchasing power.

How Does Purchasing Power Work? You’ve heard the term before — but really, what does ‘purchasing power’ mean? In its most basic form, purchasing power means what you can buy for a given amount of money. For example, a cup of coffee that cost $1 in 2010 now costs almost $4 (thanks, Starbucks!). You buy less gas with $25 today than you did a few years ago, and a car that costs $35,000 once could be bought for less than $10,000. So the purchasing power of a dollar has dropped over time. Inflation makes items cost more and lessens purchasing power.

Buy Low …

So when costs are low, it’s better to buy, before they rise, right? That may not exactly work with a cup of coffee, but it definitely works with things like cars, airplane tickets, and of course houses. When it comes to buying a home, your purchasing power is directly related to several factors, including the availability of desirable homes, average home prices, and the current mortgage rate.

Today’s interest rates are still astonishingly low. The average rate for 30-year fixed-rate loans over the last 40 years has been around 8.9 percent. But over the last several months, mortgage rates have been in the 3-4% range. This is significantly lower than the historic average — but higher than it was a year ago. Experts are predicting mortgage rates to steadily go up, possibly to as high as 5% by the end of the year.

Little Numbers, Big Difference Five percent might not seem like a lot, but when you do the math, you’ll see that even a quarter of a percent rise in mortgage rates will significantly lessen your purchasing power and make a big difference to how much you end up paying for your home. Just check the following chart, which assumes you put 20% down (although loans are available with only a 3% down requirement — call me to learn more!).

| Your Monthly Payment | Rate | Loan Amount | Purchase Power |

| $1,500 | 3.75% | $323,893 | $404,867 |

| $1,500 | 4.25% | $304,915 | $381,144 |

| $1,500 | 5.00% | $287,551 | $279,422 |

Don’t be like the family who delayed and delayed buying, and ended up shopping in the $270,000 price range rather than the $380,000 range and had to settle for two bedrooms rather than three. With rates this low, the smart buyer makes a move. The market can’t sustain these numbers for long, and won’t need to as it improves. If you’re considering a home purchase, contact me today to see the strength of your purchasing power — before it drops!

Comments Off on Mortgage Rates and Purchasing Power

Orange County Real Estate Update for 6/9/2015

Orange County Housing Report: Data Can Lie

June 7, 2015 From Steven Thomas, of Reports On Housing

Sometimes we rely on data that just does not paint the correct picture.

Sometimes we rely on data that just does not paint the correct picture.

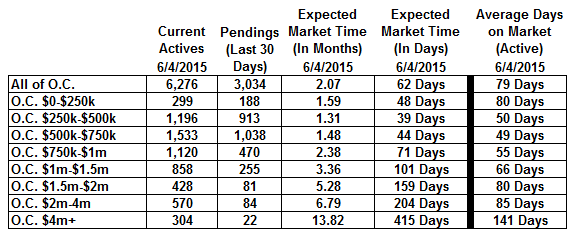

Housing Data: so many people rely on the “Days on Market” statistic and “Sold Data Indices” even though they often misrepresent what is truly going on in the marketplace today.

The average days on market for the current active inventory in all of Orange County is 79 days. For homes below $250,000 it is 80 days, over 11 weeks. Who in their right mind would sit down with a potential seller today and set an expectation of selling in 11 weeks for homes priced below $250,000? Clearly, any sound strategy to market a home will not include Average Days on Market.

The true expected Market Time for Orange County as a whole is 62 days. For homes priced below $250,000 it is 48 days. That is more like it. Sitting down with that same seller and outlining expectations between a sign in the ground to entering escrow of less than 7 weeks is a market reality. So, what’s with the huge disparity between the Market Time and Average Days on Market?

First, let’s take a closer look at how we arrive at Market Time. Market time answers how many months it will take to exhaust the current supply of active, listed homes based upon demand, the past month’s pending activity. For example, Gotham City has 100 homes currently on the market and 25 were placed into escrow within the prior 30 days. To ascertain the market time, divide 100 by 25, which is 4. So, given the most recent activity, the market time for Gotham City is 4 months.

The market can and will change and so will the Market Time; but, it is a pretty precise barometer for what everybody is experiencing in the real estate trenches today. This chart is like taking a pulse of the market. If there were suddenly a flood of listings and demand remained the same, the Market Time would increase. When demand increases, Market Time drops. However, Average Days on Market does not move as quickly and cannot accurately identify market changes and new trends.

For homes priced above $1 million, the Expected Market Time tells a completely different story compared to the Average Days on Market. The higher the price range, the larger the discrepancy. Often, luxury sellers read how the housing market is hot and mistakenly expect their home to fly off the market too. They may be encouraged by the Average Days on Market, but that is far from a market reality. For example, homes priced between $2 million and $4 million have an expected market time of nearly 7 months, not even close to the average days on market of only 85 days.

The argument against emphasizing pending sales is that many homes fall out of escrow. It happens, but not an alarming rate. Even though some pending sales do not go together, the Expected Market Time is extremely accurate and a powerful gauge of the current market. Yet, sold data is not a reliable gauge of demand TODAY. Sold data is tracked by most widely publicized housing indices, but it tells us a story of what happened about 45 to 60 days back. The market does not adhere to following what happened in the past. Instead, it does whatever it pleases today. Using pending sales over the prior month tells us what buyers are willing to do right now.

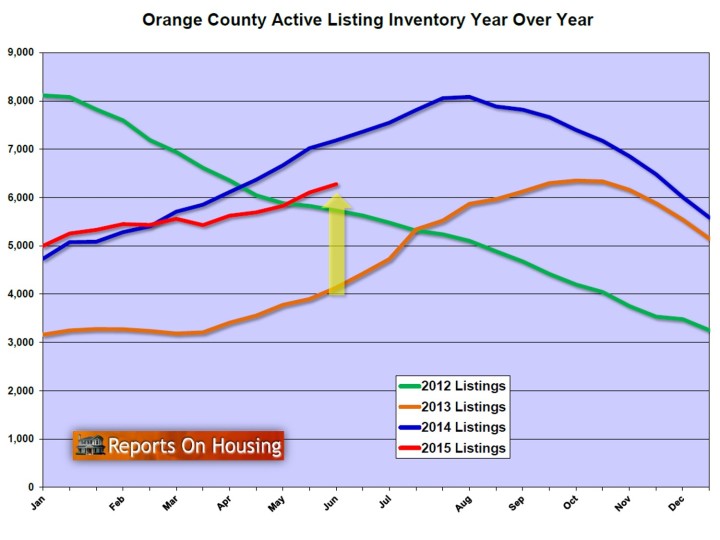

As the market slows a bit during the summer months, pending sales are going to drop slightly and the inventory will climb. As a result, the Expected Market Time will climb throughout the summer, slowing any appreciation considerably. Relying on this data is like looking out the windshield of your car, the best way to determine where you are headed. Yet, during the summer months Sold Data Indices will be elevated and indicate rising values; but, remember, this data will be a reflection of late spring, a completely different market compared to the summer. Relying on this data is like driving a car while looking out the rearview mirror.

Days on Market and Sold Data Indices often does not paint an accurate picture of what is truly going on in the housing market right NOW. Alternatively, the Expected Market Time encompasses the twists and turns as real estate evolves from season to season or responds to changes in the economy, interest rate changes, or local and global events.

Active Inventory: The inventory increased by 3% in the past two weeks.

The active inventory increased by 172 homes in the past two weeks and now totals 6,276, a 3% gain. Since the end of March, the inventory has continued to increase without pause. It looks like that trend will continue through the end of summer. The expected market time is on the rise and is currently at 62 days.

End of Steven’s report for 6/7/2015

Comments Off on Orange County Real Estate Update for 6/9/2015

Orange County Median Housing Price Hits $600,000 Mark

The median price of a home in Orange County rose to $600,000 in April, up by 4.2 percent from $576,000 in April 2014, a real estate information service announced today.

The median price of a home in Orange County rose to $600,000 in April, up by 4.2 percent from $576,000 in April 2014, a real estate information service announced today.

According to CoreLogic, the number of homes sold rose by 12.4 percent, from 3,111 in April 2014 to 3,497 last month.

“Sales activity picked up last month, making it one of the stronger Aprils since the housing bust, though sales remained below average,” said Andrew LePage, a data analyst for CoreLogic. “Many buyers still face credit and affordability hurdles, and the inventory of homes for sale remains relatively tight in many markets. New home construction is still well below historically normal levels, too.”

In A total of 21,708 new and resale houses and condos changed hands in Los Angeles, Riverside, San Diego, Ventura, San Bernardino and Orange counties last month, according to CoreLogic. That was up 9.9 percent from 19,706 in March and up 8.5 percent from 20,008 in April 2014.

The median price for a Southern California home was $429,000 in April, up 0.9 percent from $425,000 in March and up 6.2 percent from $404,000 in April 2014.

If you have been looking to buy a house in Orange County, you know that the process has been a bit frustrating. Nice homes are selling quickly, frequently with multiple offers. ( Multiple buyers offering on the same property.) My past few sales have all involved such a challenge.

Fortunately – for MY clients – I’m very experienced in such situations, and in every case ours was the successful offer. And, NO, it’s not always about having the highest offer.

Need some good news? This present flurry will pass – probably in only a month or two. If you can exercise a little patience, waiting until late July, or early August, most of the highly competitive buyer activity will likely start to cool down, making for a better environment for a home buyer. The last part of almost every year is a much better time to buy, with fewer competitive buyers, and more houses coming onto the market – a perfect storm for a home buyer.

If you NEED to buy sooner than later, just make sure you’re working with an experienced agent, who can guide you through all the potholes of a real estate purchase. With over 38 years of local service, I happen to be just such an agent, and would be honored to go to work with you, to help find your next home.

Give me a call at (949) 887-5305, or shoot me an email to BobPhillipsRE@gmail.com, and let’s go shopping!

Comments Off on Orange County Median Housing Price Hits $600,000 Mark

Signs of a Neighborhood on the Rise

A neighborhood on the rise offers things you definitely want: a great space at a good price, and the promise of improvement (and rising home equity). But how do you know when a neighborhood is getting ready to take off? There a few signs to look for that can steer you to the next hot zip code. (Remember, Brooklyn was once considered highly undesirable!)

A neighborhood on the rise offers things you definitely want: a great space at a good price, and the promise of improvement (and rising home equity). But how do you know when a neighborhood is getting ready to take off? There a few signs to look for that can steer you to the next hot zip code. (Remember, Brooklyn was once considered highly undesirable!)

It’s near another hot spot.

Location, location, location! If you can’t afford the prices in the currently desirable metro area, then look at the neighborhoods adjoining. It’s likely the amenities you’ll find there will be creeping into the adjoining neighborhoods, and yours could be next.

You can get there from here.

Excellent public transportation and freeway access generally mean young people moving in, which in turn leads to…

…Independent business and trendy shops popping up.

A young demographic in a neighborhood generally attracts bars and restaurants that are chasing millennial dollars. Look for store and restaurant trends that you’ll find in the already hot neighborhoods — farm-to-fork, wine bars, even vape bars. And of course an uptick in the number of hardware and home improvement stores is always a good sign.

Upscale chain stores are also encroaching.

These businesses spend a lot of money tracking demographics and conducting market research before they begin to move into an area. Let them do some of the groundwork for you. Stores catering to a higher income clientele, such as Trader Joes, Whole Foods, and of course Starbucks are the ones to watch.

Homes are selling faster and faster in the area

If you notice a lot of houses undergoing renovations or new home construction, and more For Sale signs, it’s time to ask your real estate agent the average time a home in that area spends on the market. As the number of days on the market declines, the housing market in the area will be heating up. If you can get in at the beginning of this trend, you’ll probably get a great price on your new property.

Looking for a neighborhood on the rise is always taking a chance. There’s no guarantee you’ll be getting in on the next most desirable place to live in your area. But by looking at the signs listed above — and having a great real estate agent who knows the area and can offer guidance — you could be getting a great place for a much lower price. With over 38 years of continuous service in South Orange County, I not only know the area, but have the experience to guide you well.

Give me a call, ( 949-887-5305 ) or shoot me an email, ( BobPhillipsRE@gmail.com ) and let’s go house shopping!

Comments Off on Signs of a Neighborhood on the Rise

What’s Ahead For Mortgage Rates This Week – March 2, 2015

Last week provided several housing-related reports including New Home Sales, Pending Home Sales and Existing Home Sales reports. Case-Shiller and FHFA also released data on home prices. The details:

Last week provided several housing-related reports including New Home Sales, Pending Home Sales and Existing Home Sales reports. Case-Shiller and FHFA also released data on home prices. The details:

Sales of Pre-Owned Homes Hit Nine-Month Low

According to the National Association of Realtors® (NAR), Sales of pre-owned homes dropped to a seasonally-adjusted annual reading 4.82 million sales in January as compared to an estimated reading of 4.95 million sales and December’s reading of 5.07 million existing homes sold. This was a month-to-month decline of 4.90 percent, and represented the lowest reading for existing home sales in nine months.

Lawrence Yun, chief economist for the NAR, said that a short supply of available homes coupled with rising prices contributed to the drop in sales. While mortgage rates remain near historical lows, higher home prices and short supply are negatively impacting affordability; this puts home buyers who rely on mortgages in competition with cash buyers.

More encouraging news arrived with the Commerce Department’s new home sales report; new home sales reached 481,000 sales on a seasonally-adjusted annual basis in January. Analysts had expected new home sales of 467,000 new homes based on December’s reading of 482,000 new homes sold in December.

Pending Home Sales Highest Since August 2013

The National Association of Realtors® reported that pending home sales rose by 1.70 percent in January as compared to December’s reading of -3.70 percent. Pending sales were up 8.40 percent year-over-year. Job growth, a little more leniency in mortgage credit standards and slower inflation were seen as factors that contributed to higher pending sales. Pending sales represent under sales contracts that have not closed.

Case-Shiller, FHFA Post Home Price Data

The Case Shiller 20-City Composite reported that home prices rose by 0.10 percent month-to-month and 4.50 percent year-over-year according to its index report for December. San Francisco, California had the highest year-over-year price gain at 9.30 percent, while Chicago, Illinois had the lowest year-over-year home price appreciation rate at 1.30 percent as of December.

FHFA reported that home prices for properties connected with Fannie Mae and Freddie Mac loans rose by 5.40 percent on a year-over-year basis as compared to November’ year-over-year reading of a 5.20 percent increase in home prices.

Mortgage Rates Rise

Freddie Mac reported that average mortgage rates rose across the board last week. The rate for a 30-year fixed rate mortgage rose by four basis points to 3.80 percent; the average rate for a 15-year fixed rate mortgage increased by two basis points to 3.07 percent and the rate for a 5/1 adjustable rate mortgage was also two basis points higher at 2.99 percent. Discount points for all loan types were unchanged at 0.60 percent for fixed rate mortgages and 0.50 percent for 5/1 adjustable rate mortgages.

What’s Ahead?

This week’s scheduled economic news includes consumer spending, construction spending and the Labor Department’s non-farm payroll and national unemployment reports. Weekly jobless claims and Freddie Mac’s PMMS report on mortgage rates will be released as usual on Thursday.

Comments Off on What’s Ahead For Mortgage Rates This Week – March 2, 2015

Four Excellent Reasons to Buy a Home So You Can Get out of the “Renting Rut”

Renting a home is a good option for some, but buying a home just might be the best thing for you.

Renting a home is a good option for some, but buying a home just might be the best thing for you.

There are some big advantages to buying a house that will help you get out of your renting rut and focus more on your future.

#1.) Build Equity

Did you know that when you rent a home, you help someone else build equity? Any changes that you make with your landlord’s approval puts money back in his or her pocket. Keeping the yard clean and taking care of routine maintenance builds equity in that property. When you buy a home of your own, you have the chance to build equity of your own, which can add significantly to your net worth.

#2.) Save On Your Taxes

When you rent a house, you cannot deduct the money you spend on your taxes. Though some states will let you make a small deduction based on the total amount you spend in rent each month, you cannot make any deductions on your federal taxes. When you buy a home, you can save with a few different types of deductions.

The federal government lets you make a deduction if your home is worth more than what you currently owe on your taxes. If you purchased your first home, you can make a deduction in regards to your property taxes. You can also deduct money that you spend on some renovations and energy saving appliances.

#3.) Put Your Personal Touch On Things

As long as you continue renting, you live in a home that belongs to someone else. Your landlord has final say over what you do and do not do. This often means that you cannot make repairs or significant changes without seeking approval first.

Renting a home lets you put your personal touch on things. You can paint the walls any colors you want, rip out the carpet to add hardwood flooring or even make significant changes outside to turn your new home into your dream home.

#4.) Interest Rates Are STILL Incredibly LOW!

One factor that has contributed to home affordability has been the incredibly low interest rates that have been available for the last couple of years.

Now that you know more about the benefits of buying a home and how that purchase can get you out of the rental rut you’re in currently, isn’t it a good time to give me a call? I would be thrilled to assist you in becoming a homeowner. Let’s go home shopping!

Comments Off on Four Excellent Reasons to Buy a Home So You Can Get out of the “Renting Rut”

Three Tips for Reducing Your Closing Costs if You’re Looking Forward To Buying a Home in the Spring

Spring is approaching fast and it is usually the busiest time of the year for home buying. After a long and cold winter, many people are ready to enjoy the nicer weather and begin to shop for a new home. Spring is also the perfect time for home buying for families with children because it allows them to move during the summer without interrupting school.

Spring is approaching fast and it is usually the busiest time of the year for home buying. After a long and cold winter, many people are ready to enjoy the nicer weather and begin to shop for a new home. Spring is also the perfect time for home buying for families with children because it allows them to move during the summer without interrupting school.

Home buying has costs associated with it other than the mortgage itself. Known as closing costs, these fees are a part of the home buying process and they are due at the time that the mortgage is finalized. Buyers, however, can negotiate these costs and reduce the expense with a little bit of effort and with the help of a good mortgage professional.

If you are thinking of buying a new home in the spring here are three helpful tips to reducing your closing costs.

Compare All of Your Mortgage Options

If you’re using mortgage financing to cover some of the up-front purchase cost of your home you’ll have other closing costs to pay including lender fees, mortgage insurance and more. Be sure to compare all of your options with your trusted mortgage adviser to ensure that you’re getting the best possible deal and paying the least amount in fees and interest.

You may also be able to save a bit on your closing costs by choosing a “no points” mortgage. In this type of mortgage you’ll end up saving on closing costs but you’ll be left paying a higher interest rate. Spend a bit of time doing the math to determine the best course of action.

Third Party Fees

Some of the closing cost fees will be associated with third party vendors that must perform required services. Home appraisals, title searches, and costs for obtaining credit reports are some of the items included in this area. While these may be a little harder to negotiate because the lender uses specific companies to perform these services, it does not hurt to ask if you can use your own appraiser or title search company.

Zero Closing Cost Mortgages

Buyers may also wish to inquire about a no closing cost mortgage. This type of mortgage eliminates all closing costs. The lender covers all of the closing cost fees in exchange for a slightly higher interest rate on the loan. In most cases the increase is less than one-quarter of a percent. This type of loan can be very helpful to buyers. Buyers can then use the money that they saved on closing costs to help with the move.

With a little preparation, you can find the best mortgage product for the up-coming spring season. Be sure to contact your experienced mortgage professional, as they will be able to help you find the right mortgage for your specific needs with the lowest out-of-pocket expenses.

You may also be able to save a bit on your closing costs by choosing a “no points” mortgage. In this type of mortgage you’ll end up saving on closing costs but you’ll be left paying a higher interest rate. Spend a bit of time doing the math to determine the best course of action.

Comments Off on Three Tips for Reducing Your Closing Costs if You’re Looking Forward To Buying a Home in the Spring

From RealtyTrac: Buying is more affordable than renting almost everywhere

A new blog from Trey Garrison of HousingWire.com, dated December 26th, 2014.

From RealtyTrac: Buying is more affordable than renting almost everywhere

“Buying is still more affordable than renting in the majority of U.S. housing markets, while the opposite is true in markets with the biggest increase in the millennial share of the population over the last six years, according to RealtyTrac.

“Buying is still more affordable than renting in the majority of U.S. housing markets, while the opposite is true in markets with the biggest increase in the millennial share of the population over the last six years, according to RealtyTrac.

RealtyTrac analyzed 2015 fair market rental data recently released by the U.S. Department for Housing and Urban Development for three-bedroom properties in 543 counties nationwide with a population of at least 100,000. In the 473 counties with sufficient rental and home price data, the fair market rent for a three-bedroom property in 2015 will require an average of 27% of median household income, while buying a median-priced home requires an average of 25% of median household income based on the median sales price in November.

Buying a median-priced home was more affordable than renting a three-bedroom property in 68% of the counties analyzed, representing 57% of the total population in those counties.

But in the 25 counties with the biggest increase in millennials between 2007 and 2013, fair market rents for a three-bedroom property in 2015 will require 30% of the median household income on average while buying a median-priced home requires 36% of median household income on average. For the analysis millennials were defined as anyone born between 1977 and 1992.

“First-time buyers and potential boomerang homebuyers are stuck between a rock and a hard place in today’s housing market: many of the markets with the jobs and amenities they want have hard-to-afford rents and even harder-to-afford home prices; while the more affordable markets have fewer well-paying jobs and tend to be off the beaten path,” said Daren Blomquist, vice president at RealtyTrac. “Those emerging markets with the combination of good jobs, good affordability and a growing population of new renters and potential first-time homebuyers represent the best opportunities for buy-and-hold real estate investors to buy low and benefit from rising rents in the years to come.”

The top markets with the biggest increase in the percentage of millennials over the past seven years were counties in Washington, D.C., San Francisco and Denver, all of which saw an increase of more than 50% in the share of the population that is millennials.

Other markets in the top 25 for biggest increase in millennials included counties in New York, Nashville, Portland, St. Louis, Seattle, Charlotte, Minneapolis, Indianapolis, Atlanta, Orlando, Austin, Des Moines and Midland, Texas.” ( End of Trey’s blog.)

Comments Off on From RealtyTrac: Buying is more affordable than renting almost everywhere

Comments Off on Why October is the Best Time to Buy a House